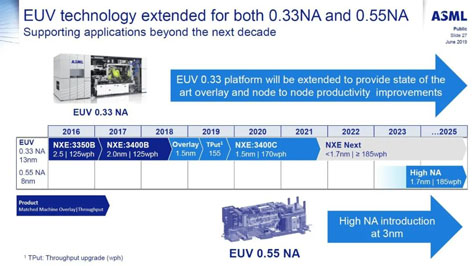

01. ASML's new generation EUV equipment is pre-sold to customers

The Netherlands ASML company is stepping up the development of its next-generation EUV extreme ultraviolet lithography machine with high NA (0.55 numerical aperture). During the release of the latest financial report, AMSL revealed that its stock EUV customers have ordered a new generation of equipment.

Specifically, after Intel and TSMC, Samsung, SK Hynix, and Micron also placed orders for high-NA EUV lithography machines.

A high NA EUV lithography machine allows the processing of more precise semiconductor chips with higher production efficiency, and it is also a necessary condition for 2nm and more advanced processes.

02.Intel Is Set To Begin ‘targeted’ Layoffs In November!

According to sources, Intel Corp. plans to announce “targeted” layoffs in November, citing an internal video shared with staff. The Oregonian reported after the market closed Thursday that Intel (INTC) Chief Executive Pat Gelsinger addressed workers via video.

Also Promised additional details on Nov. 1. Intel, located in Santa Clara, California, operates a huge facility outside of Portland, Oregon.

According to the story, Gelsinger told staff, “These are always difficult decisions, but our expenses are too high and our margins are too low.” “Action must be taken to address them.”Margin has been a source of contention for Gelsinger.

Since announcing his capital buildout strategy upon taking over as CEO of the chipmaker in early 2021. Already, the CEO has had to backtrack on last year’s claim that margins would remain “comfortably over 50%,”.

Since the annual margin prediction for the year has dropped to 49%, competitor Advanced Micro Devices Inc. (AMD) margins have just breached the 50% threshold. Intel is expected to publish results after the markets close on October 27.

Intel last disclosed a big round of layoffs in 2016, when it announced 12,000 job cuts, or 11% of its employees, on the same day it reported quarterly profits. Intel employs over 121,000 people worldwide.

03.Global smartphone demand is expected to continue to decline

Norio Nakajima, president of the world's largest MLCC maker, said in a recent interview that the decline in smartphone sales this year will continue until 2023.

Consumers in China, the world's largest smartphone market, have yet to respond to the spending boom, and Murata sees little prospect of a rebound next year. "At least in fiscal 2022, the momentum will not resume and the situation will not be so optimistic going into the next period," Norio Nakajima said.

"If the economy improves, consumers may be willing to buy a new phone, even if it's a small upgrade. My concern is that smartphones will become more commoditized and people will wait longer before upgrading," Nakajima said.

According to Murata's estimates, the global mobile phone market was 1.36 billion units last fiscal year, but this year's figure is likely to be less than 1.2 billion.

04.TSMC: Inventory adjustment in chip supply chain may extend into first half of 2023

TSMC President C.C. Wei said yesterday that the semiconductor supply chain continues to destock, and it is expected that the inventory level will peak in the third quarter and decline in the fourth quarter. The inventory adjustment will last for several quarters and may extend to the first half of 2023.

C.C. Wei believes that the impact of inventory adjustments will continue, and it is estimated that the semiconductor industry may fall into recession in 2023.

In addition, TSMC's 7-nanometer capacity utilization rate has weakened in the short term due to changes in market demand, mainly because some customers of mobile phones and PCs have experienced inventory adjustments.

05.Chip lead time continue to shrink in September

According to Susquehanna Financial Group, global chip lead time fell by four days in September, the biggest drop in recent years, reflecting an easing of chip supply shortages.

The report noted that chip lead times now average 26.3 weeks, compared to nearly 27 weeks a month earlier.

Susquehanna analyst Christopher Rolland said wait times decreased across all key product categories, with power management and analog chips seeing the biggest declines.

It is worth mentioning that the supply shortage of industrial and automotive chips still exists, but many consumer electronics chip makers are worried that the chip inventory is too high.

06.TrendForce: Estimated annual server shipment growth of 3.7% next year

According to the latest survey by TrendForce, the tight material situation after the epidemic has improved in the second half of this year, and the supply and delivery of short-term materials has recovered significantly. However, under the condition that the supply of materials is safe and the demand can be met, the annual growth rate of server shipments in 2023 is estimated to be only 3.7%, which is lower than the 5.1% in 2022.

According to TrendForce, the slowdown in growth is affected by three factors. First, after the long-term and short-term material problem is alleviated, the buyer is also adjusting the excess orders in the past, so the ODM orders are also reduced, but it will not affect the server integration in 2022 for the time being. Machine shipments. Second, due to the impact of high inflation and a weakening economy, corporate capital expenditures may be more conservative, and IT-related investments will be more flexible, such as replacing some end servers with cloud services. Third, changes in the international situation have made the demand for small-scale data centers continue to emerge, and the construction of super-large-scale data centers in the past will slow down.