Abstract

Benefiting from the increase in data center speeds and continued construction of data centers, the Ethernet PHY Chip market is experiencing a period of rapid growth. This report will introduce the basic market conditions on the supply and demand sides of Ethernet PHY Chips, the product landscape, and changes among enterprises. It will also summarize the seven major global manufacturers of Ethernet PHY Chips.

Demand side: The main downstream application markets for Ethernet PHY Chips include data centers, enterprise network communications, automotive electronics, consumer electronics, and industrial control.

Supply-side PHY Chips market has concentration of manufacturers, with the major players being Broadcom, Marvell, Realtek, TI, Qualcomm, and Microchip. The main manufacturers of automotive Ethernet PHY Chips include Marvell, Broadcom, Realtek, TI, and NXP.

1 Ethernet PHY Chip Market Overview

1.1 Ethernet PHY Chip Product

Ethernet Physical Layer (PHY) chips, also known as transceivers, are one of the essential foundational chips in wired data communication and transmission. It operates at the first layer of the network model and are communication chip used for wired Ethernet transmission, enabling the connection between different devices.

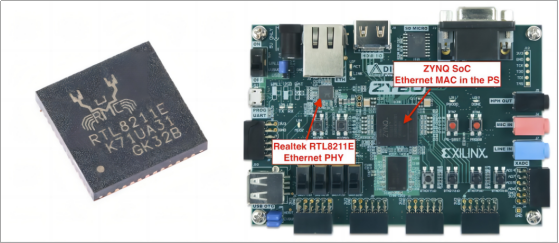

Exhibit 1: Ethernet MAC and PHY Chip In Zybo Motherboard

1.2 Ethernet PHY Chip Classification

Based on performance and downstream applications, Ethernet PHY chips can be divided into three main categories:

Commercial Grade: Suitable for applications requiring Ethernet communication in consumer and security fields such as security cameras, televisions, and set-top boxes;

Industrial Grade: Suitable for applications requiring Ethernet communication in telecommunications, data communication, and industrial fields such as switches, industrial internet, and industrial control;

Automotive Grade: Suitable for in-vehicle Ethernet applications such as advanced driver-assistance systems (ADAS) and LCD dashboards.

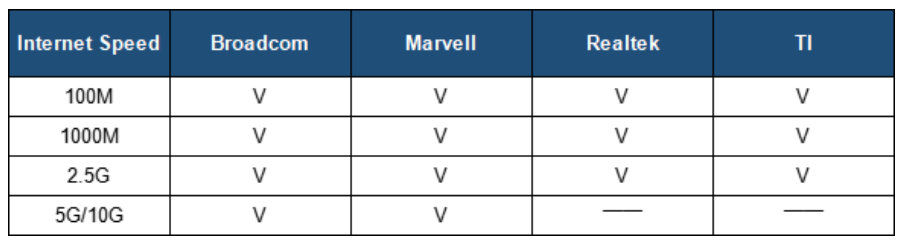

According to different network transmission speeds, the independent Ethernet Physical Layer (PHY) chip products based on copper twisted pair in the market can mainly be divided into 100M PHY, Gigabit PHY, 2.5G PHY, 5G PHY, and 10G PHY.

Exhibit2: The Main Ethernet PHY Chip Manufacturers’ Product Information According To The Rate

By standard:

IEEE 802.3 Standard PHY Chips: Ethernet PHY chips that comply with the IEEE 802.3 standard, supporting various speeds and connection standards.

Custom PHY Chips: Customized PHY chips designed for specific applications or market demands, supporting particular speeds and connection standards.

By function:

Basic PHY Chips: Provide fundamental physical layer interface functions, including carrier detection, encoding/decoding, and data transmission.

Advanced PHY Chips: In addition to basic functions, they support advanced features such as auto-negotiation of speeds, cable diagnostics, and remote fault detection.

1.3 Ethernet PHY Chip Market

Ethernet PHY chips are widely used in various market sectors, including data centers and enterprise networks, communications, automotive electronics, consumer electronics, and industrial control.

Automotive Electronics (fastest-growing): The trend of Ethernet replacing traditional automotive bus technologies is becoming predominant.

Industrial Control (second fastest-growing): Industrial automation and intelligence are the mainstream trends, with industrial Ethernet PHY standalone chips being the primary choice.

With the advancement of information construction, technological progress in automotive intelligence and connectivity, the proliferation of smart TVs, high-definition transmission channels, network HD surveillance, and the development of industrial automation and intelligence, the Ethernet downstream market is thriving, leading to a continuous increase in demand for Ethernet PHY chips.

In 2023, the global Ethernet PHY chip market size was approximately $10.34 billion. According to MRFR, the Ethernet PHY chip market is expected to grow from $11.25 billion in 2024 to $14.22 billion in 2026, with a compound annual growth rate (CAGR) of 14%.

2 Supply Chain Analysis

2.1 Product Price and Lead Time

From the following data, it can be observed that the delivery times for most Ethernet PHY chip manufacturers have remained stable, with the exception and Semtech, whose delivery times are trending toward an extension. The long-term extension in delivery times is likely due to the rapid development of emerging technologies such as 5G, data centers, IoT devices, and electric vehicles, which has significantly the global demand for semiconductor chips. It is anticipated that as the global supply chain gradually recovers and production capabilities improve, delivery times will see some improvement. However, in the short term, these challenges will still need to be addressed.

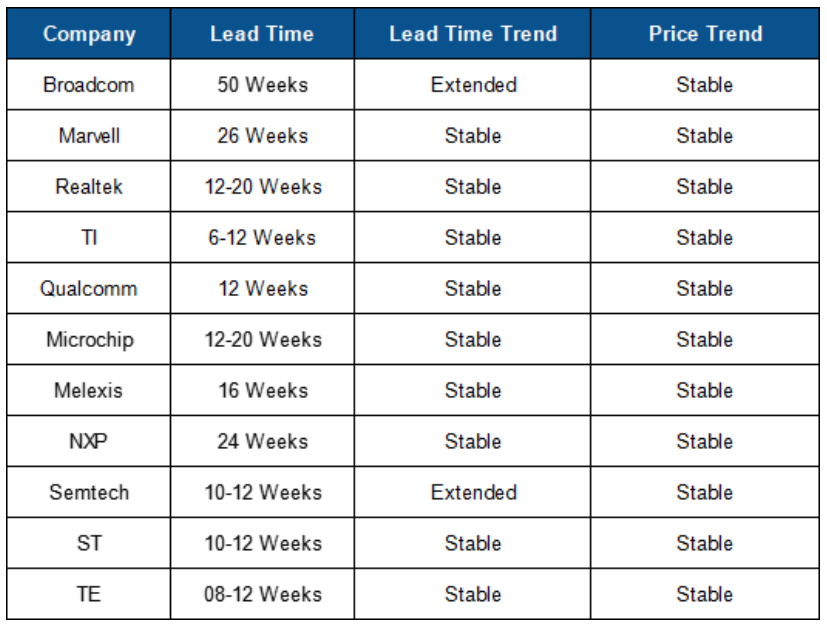

Exhibit 3: Ethernet PHY Chip Manufacturers Price and Lead Time In May