1.Korea’s Exports of Key Memory Chip Plummet as Demand Chills

South Korea’s exports of its most lucrative memory chip fell by the most since 2019, indicating a deepening slump in technology demand central to global economic growth.

Shipments of dynamic random access memory fell 24.7% from a year earlier in August, compared with a 7% decline in the previous month, according to data released Friday by the trade ministry.

DRAM accounts for almost half of Korean exports of memory chips, and works with processors and other types of semiconductors to store and process information in a wide range of electronics.

Samsung Electronics Co. and SK Hynix Inc., both based in Korea, control roughly two thirds of the world’s memory market. Their revenues were hit in 2019 when the memory-chip industry entered a bust cycle.

Korea’s tech exports, which account for a third of the country’s total shipments abroad, fell 4.6% in August, separate data from the ministry showed. Smartphones, displays and computers all declined in shipment value as consumer demand slackened, the ministry said.

2.China announced that the domestic 14nm process has been mass-produced

According to public information, in the first seven months of this year, Chinese companies have cut orders to import more than 43 billion chips! This is not because the demand in the domestic chip market has decreased, but with the concerted efforts of domestic foundry companies such as SMIC and Hua Hong Semiconductor, the self-sufficiency rate of domestic chips with mature manufacturing processes has been visibly improved.

At the same time, on September 14, exciting good news came from domestic chips again, saying that the Shanghai integrated circuit industry has broken through the 14nm chip process and achieved mass production. In this regard, the director of the Shanghai Economic and Information Commission also officially confirmed.

At the special series of press conferences on "Forge ahead in a new journey and make contributions to a new era" held by the Foreign Affairs Office of the Shanghai Municipal Committee. In Shanghai's economic informatization work, Wu Jincheng, director of the Municipal Economic Informatization Commission, said that in the field of integrated circuits, Shanghai enterprises have achieved mass production of 14-nanometer advanced technology, 90-nanometer lithography machine, 5-nanometer etching machine, and 12-inch large silicon wafers. , domestic CPUs, 5G chips, etc. have all achieved breakthroughs.

3.Intel, ARM&NVIDIA to jointly develop AI technology

Recently, Intel, together with ARM and NVIDIA, is preparing to develop high-performance artificial intelligence (AI) semiconductor technology. These companies will solve the computing needs related to AI semiconductor technology, and will also be connected to other computer fields, such as AI semiconductor computing technology and data processing technology.

It is reported that Intel will apply AI technology to its central processing unit (CPU) and graphics processing unit (GPU) line, and will also be used for its own Havana and Gaudi deep learning processors. After acquiring AI startups, Intel has stepped up R&D of processors to meet the demand for AI semiconductors.

Intel also said it was planning to develop technology for AI from ARM and Nvidia, establishing a standardized format based on the International Institute of Electrical and Electronics Engineers (IEEE).

After facing a period of business obstruction and revenue decline, Intel is gradually finding its own rhythm and making efforts in many fields. Perhaps as Intel officially said, Intel will regain its market share in the next few quarters. With such a "big move" in the AI ??field this time, Intel must also want to use this to make its processors more competitive.

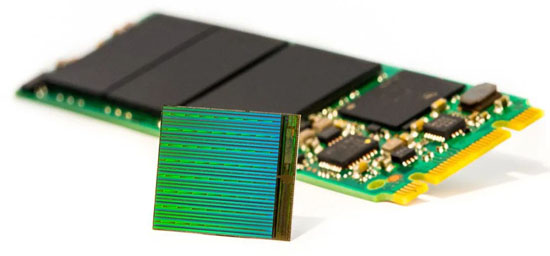

4.Micron Unveils Plans For $15 Billion Chip Manufacturing Plant In Idaho

Micron recently announced its plan to invest approximately $15 billion through the end of the decade in advanced memory manufacturing in Boise, the largest private investment ever made in Idaho. This is part of Micron’s earlier disclosed plans to invest $40 billion through the end of the decade to establish leading-edge memory manufacturing in the U.S. Although the near-term demand environment for memory and storage is challenged, memory market revenue is expected to double by 2030. New wafer production capacity will therefore be required to meet long-term demand in market segments like data center, industrial, automotive and mobile, fueled by adoption of artificial intelligence and 5G. The Boise manufacturing investment is part of the Micron’s strategy to increase U.S.-based DRAM production to 40% of the company’s global output in the next decade. Micron is in the final stages of its selection process for another high-volume manufacturing site in the U.S.

Construction on the new fab in Boise is expected to begin in early 2023, with cleanroom space coming online in phases starting in 2025. New DRAM production is targeted to start in 2025, ramping over the second half of the decade in line with industry demand growth. Ultimately, the cleanroom space will reach 600,000 square feet — the size of approximately 10 U.S. football fields and the largest single cleanroom ever built in the country.

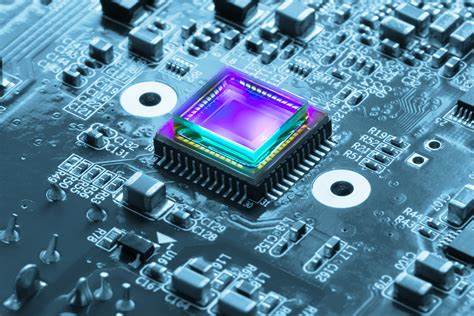

5.CMOS Image Sensors Stall in ‘Perfect Storm’ of 2022

Optoelectronics’ biggest product category is expected to suffer its first sales decline in 13 years because of a smartphone slump, low camera growth in handsets, and weak global economy, says IC Insights

For most of the last two decades strong growth in CMOS image sensors pushed this product category to the top of the optoelectronics market, in terms of sales volume, generating over 40% of total opto-semiconductor annual revenues. In 2022, however, the CMOS image sensor market category is on track to suffer its first decline in 13 years with sales expected to fall 7% to $18.6 billion and unit shipments projected to drop 11% to 6.1 billion worldwide, according to IC Insights’ August 3Q Update of The McClean Report service (Figure 1).

The projected 2022 decline in CMOS image sensors comes after two years of meager sales growth in 2020 (+4%) and 2021 (+5%). This year’s sales drop reflects overall weakness in consumer smartphones and portable computers with digital cameras for video conferencing following an upsurge in demand for Internet connections and online conferencing capabilities during the Covid-19 virus pandemic. The 3Q Update forecast shows a modest recovery in CMOS image sensors next year with market revenues growing 4% to $19.3 billion and then rising 13% in 2024 to reach a new record high of $21.7 billion.

In addition to weak demand in mainstream consumer camera cellphones and portable computers, CMOS image sensors have been negatively impacted by deteriorating global economic conditions resulting from high inflation and spiking energy costs caused by the Russian war in Ukraine as well as U.S. trade bans on China, recent Covid-19 virus lockdowns in Chinese manufacturing centers, and slowing growth in the number of cameras being packed inside of new smartphones. Some high-end smartphone models contain five or more cameras, but the average in most handsets has stayed at three (one on the front, facing the user for “selfie” photos and two main cameras on the backside of phones). IC Insights’ 3Q Update Report says some managers in China have described the image sensor market conditions as a “perfect storm,” combining a slowdown in mainstream mid-range smartphone shipments and an unanticipated pause in the increase of embedded cameras being designed in new handsets.

CMOS image sensor market leader Sony—which accounted for about 43% of CMOS image sensor sales worldwide in 2021—reported a 12.4% sequential decline in image sensor dollar-volume revenues (-2% in Japanese yen) during the company’s fiscal 1Q23 quarter, ended in June 2022. In the first half of calendar 2022, Sony struggled to match image-resolution requirements for camera phones and its CMOS image sensor sales to leading Chinese system manufacturers were lowered by U.S. trade bans. Sony still believes excess inventories of phones and image sensors will be reduced by early 2023 and market conditions will “normalize” in the second half of its current fiscal year (ending next March).