Abstract

MLCC, often referred to as the "Rice of the Electronics Industry," commands the largest share among the three basic components. It finds widespread application in smartphones, electric vehicles, 5G stations, and more.

Since 2016, MLCC has faced challenges such as extended delivery times and rising prices. However, after 2021, there was a significant decline in shipment volumes, reaching a low point. Nonetheless, with the end of the pandemic, the demand for consumer electronics, automobiles, and other end products has rebounded, leading MLCC into a phase of recovery.

From a global perspective in terms of market conditions and scale, there is a trend of stable growth, with continuous technological advancements and relatively stable manufacturing capacity among producers, resulting in minimal fluctuations in product prices. The Asia-Pacific region dominates the market, while markets in the United States, Japan, China, India, and other areas also demonstrate promising development prospects.

1 MLCC Overview

1.1 MLCC Foundation Concepts

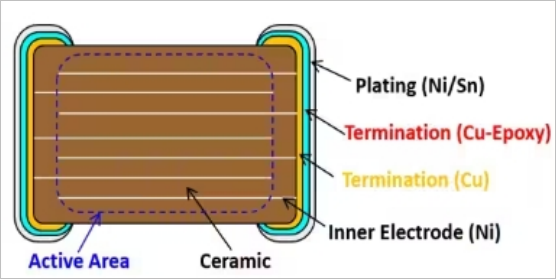

A multi-layer ceramic capacitor is a capacitor made of a ceramic dielectric diaphragm with a printed electrode (inner electrode), which is superimposed in a misplaced way, and a ceramic chip is formed by one-time high-temperature sintering, and then a metal layer (outer electrode) is sealed at both ends of the chip, to form a similar monolithic structure, it is also called a monolithic capacitor. MLCC is a key passive component in electronic devices, originating in the 1960s. It was first developed by American companies but later industrialized largely due to efforts by Japanese enterprises like Murata, TDK, and Taiyo Yuden. These companies have maintained dominance in the MLCC sector to this day.

Exhibit 1: Passive Component Classification

MLCCs boast qualities like compact size, high specific volume, durability, and reliability, making them perfect for surface mounting. Consequently, they find extensive applications across various electronic devices such as computers, phones, control switches, precision instruments, radar systems, and more. Remarkably, they're even integrated into everyday items like cars, with a single smartphone utilizing over a thousand ceramic capacitors, and a typical car likely incorporating more than 8,000. These capacitors optimize circuit performance, facilitating product miniaturization and integration while ensuring the smooth functioning and feature realization of electronic products across diverse fields. This, in turn, fosters sustainable growth and technological innovation within the electronics manufacturing industry.

Exhibit 2: MLCC Structure

1.2 MLCC Market Size and Trend

In 2021, the global MLCC market was valued at $10.9 billion. By 2030, it's projected to soar to $16.77 billion, boasting a compound annual growth rate (CAGR) of 5.6% throughout the forecast period(2020-2030).

This growth is primarily propelled by surging demand from the automotive sector, fueled by the increasing adoption of electric vehicles, alongside the advancement of 5G technology. MLCCs stand as one of the most prevalent passive components, commanding over 50% of the entire capacitor market share. Their exceptional performance not only makes them indispensable in various electronic devices but also enables their application in large-scale machinery and equipment, further driving the expansion of the MLCC market share in the coming years.

Anticipated developments in technological innovation, intelligent production methods, expansion into new application fields, and a focus on environmental sustainability will continue to shape and propel the growth of the MLCC market in the forthcoming years.

Exhibit 3: MLCC Main Manufacturers Technology Evolution

However, due to the global economic slowdown and the cautious growth in the technology industry, TrendForce predicts that MLCC suppliers shipped only 1,110.3 billion units in the first quarter of this year, marking a 7% decrease from the previous quarter.

Exhibit 4: 23Q3-24Q1 MLCC Supplier Shipmen

It is worth noting that Intel's upcoming platform, Meteor Lake, set to debut in 2024, will feature the first AI system computing power alongside a new Neural Processing Unit (NPU). While these enhancements aim to boost overall computing efficiency, they also lead to increased power demands and rising system operating temperatures. Consequently, there is a need to ramp up the power supply lines for two NPU groups, resulting in a rise of about 90 to 100 MLCC units per unit. Specifically, specifications like 2.2u 0201, 10u 0402, and 47u 0603 are most prevalent. As new platform models are gradually introduced in the latter half of the year, even if the overall order of notebook computers remains unchanged or slightly increases from last year, the demand for notebook MLCC usage will grow.

2 MLCC Products Insight

2.1 MLCC Products Price Trend

The MLCC shortage began in the second half of 2016 and lasted until 2018. During this time, almost all product lines, including GRM155R71C104KA88D, GRM21BR61E475-KA12L, and 06035C103KAT2A, experienced extended lead times and rising prices. Industry experts predicted that this trend would continue until 2020.

However, in the second half of 2021, there was a sharp decline in shipments of mobile phones, home appliances, and other terminals, leading to a decrease in demand for MLCCs. As a result, prices for MLCCs began to decrease. By September 2022, the prices of some MLCC models had reached their lowest levels in history and showed no signs of dropping further. According to a report from CCTV Finance, MLCC prices continued to decline for over 14 months.