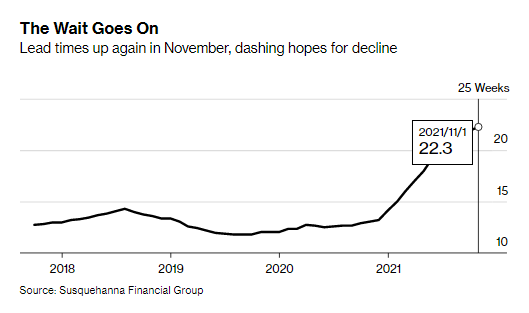

1、November chip delivery period lengthens by another four days to 22.3 weeks

On November 8, Susquehanna Financial Group issued a report stating that the overall chip delivery time in November has been extended again and has now reached 22.3 weeks. This has disrupted many industries’ expectations that the shortage of chips is about to slow down. The IC and microcontroller lead times are the most serious.

According to a report by Bloomberg, The lead times -- a closely watched gap between when a semiconductor is ordered and when it’s delivered -- increased by four days to about 22.3 weeks last month compared with October, according to research by Susquehanna Financial Group. That lag marks the longest wait time since the firm began tracking the data in 2017.

The results are a setback for industries that need more electronic components. Companies from Apple Inc. to Ford Motor Co. have complained that they can’t meet the demand for their own products and that their costs are rising. October’s more muted increase had fueled optimism that the situation was improving.

“While the expansion is less than most months of late, we had hoped for a clear reversal,” Susquehanna analyst Chris Rolland said in a research note.

2、Toyota embracing small flaws as supply chain pressures bite

Toyota Motor Corp on last Tuesday mentioned it’s blissful to make use of scratched or blemished components from suppliers as the world’s largest automotive producer tries to trim prices amid a production-curbing world chip scarcity and rising materials prices.

According to Reuters, "We are careful about the outside of our vehicles, the parts you can easily see. But there are plenty of places that people don't notice unless they really take a good look," Takefumi Shiga, Toyota's chief project leader for vehicle development said during a press briefing.

Shiga and other Toyota engineers are expanding a program begun in 2019 to meet component suppliers, even third-tier ones, to assure them that scratches or blemishes are acceptable as long as they do not affect vehicles' safety and performance, and are unlikely to be noticed by car buyers.

Toyota last month raised its operating profit outlook by 12% for the year ending March 31, helped by favorable currency rates. It warned, however, that a shortage of semiconductors which was curbing production and increasing material costs were hurting its underlying profitability.

3、Samsung reshuffles three major CEOs, combines mobile and consumer electronics units

Samsung Electronics has announced an internal reorganization of its businesses with several changes to leadership. The company will have two new CEOs overseeing two divisions: Device Solutions, which is the semiconductors business, and a new SET Division that includes mobile, TVs, and consumer electronics. It’s the biggest change to Samsung’s structure since 2017 when the company appointed three leaders for three separate divisions.

Jong-Hee Han, who was credited with making Samsung the leading television brand as global head of TV sales, now becomes the co-CEO of the new SET division.

The company says that in his new role, Jong-Hee Han is, "expected to strengthen the synergies among the different businesses in the SET Division and help drive new businesses and technologies."

The semiconductor division will be headed by Kyehyun Kyung, previously head of Samsung's electro-mechanics division, who is credited with success at the company's flash memory product team and the DRAM (dynamic random access memory) design team.

4、Toyota halts lines at 4 Japan plants due to supply chain woes

Toyota Motor will partially suspend operations at four plants in Japan due to delays in procuring parts from Southeast Asia.

The affected plants include the Tahara plant in Aichi Prefecture and the Miyata plant in Fukuoka Prefecture; production of a total of 5,500 units will be affected. Toyota says it will maintain its planned global production volume of 9 million units for the fiscal year ending next March.

Toyota will suspend the operation of the third production line at its Tahara plant, which produces Lexus vehicles, and the first line at its Miyata plant from Dec. 13 to Dec. 15. In addition, Toyota's Fujimatsu Plant and Yoshiwara Plant in Aichi Prefecture, which produce Land Cruisers, will cancel their holiday operations previously scheduled for Dec. 18. The third line at the Tahara plant will also cancel its scheduled holiday operations on Dec. 18 and Dec. 25.

Toyota had said on Thursday that the Tahara plant line would be suspended from Wednesday through Saturday and the Miyata line from Wednesday through Friday, impacting 3,500 units. Delays in procuring parts from Southeast Asia were behind the shutdowns. Toyota is also being affected by tight logistic channels in Japan.

The total number of vehicles affected by suspensions at the four plants will be approximately 9,000 units, less than 1% of Toyota's domestic production volume of 2.92 million units in 2020.

Since September, Toyota has drastically cut global output due to problems acquiring components. But the company had expected to normalize production this month at all 28 lines at its 14 domestic plants. The last time Toyota attained normal operations was in May.

5、Supply chain issues will continue until 2023, Intel chief says

Intel Corp., Wayfair Inc., and Accenture PLC are responsible for improving supply chain issues that spill over to the entire U.S. economy for some companies, but long-term fixes may take longer. Said at the Wall Street Journal CEO Council Summit on December 7.

Chip giant Intel, which is at the heart of the global semiconductor shortage, expects supply chain problems to continue until 2023. This is partly due to the fact that it will take three years to build the new plant, said CEO Patrick Gelsinger.

Gelsinger said in July that the global semiconductor shortage could continue until 2023.

Gelsinger said Intel has allowed supply chain consolidation in Asia, leaving it geographically unbalanced to deal with the turmoil. The company said it plans a large US factory, which he called a “mega-site,” to bring production closer to where chips are needed.

“Supply chains will not relocate overnight,” said Julie Sweet, CEO of consulting firm Accenture. “China will be an important supplier to the world, saying it will take some time for the global shift to unfold. It will continue to exist. “

6、Chinese TCL will start producing budget TVs from Panasonic

According to Japanese sources, Panasonic has nevertheless entered into a contract with the Chinese manufacturer TCL, according to which it will entrust the latter with the production of budget TVs under its own brand. For Panasonic, the Chinese TCL will start producing TVs from next year. The Japanese manufacturer will reduce its own TV production to a minimum.

Under the agreement, starting next year, TCL will manufacture the bulk of Panasonic’s budget TVs for markets such as Southeast Asia and India. To significantly reduce production costs, the two companies also intend to collaborate on procurement and panel development. The transfer of TV production to the Chinese will allow Panasonic to close two of its remaining four factories. One plant will shut down by the end of this year (this will be a plant in Brazil), and the second, in the Czech Republic, will be closed by the end of March 2022.

Panasonic will retain its Malaysian plant and Taiwan plant. Factories in Japan, Vietnam and India were closed a year earlier. The company itself will continue to produce high value-added products such as OLED models, but exclusively for the Japanese market. Overall, outsourcing will help Panasonic reduce the production of branded TVs to 1 million units per year or 5% of what was once peak production. This will reduce costs and hold out with this business a little longer, until the harsh reality forces it to abandon it altogether, as happened with other Japanese television brands.