01. Chip lead times shorten, but still 24 weeks

Market research agency Susquehanna Financial Group found that the chip supplies are rallying with an average lead time now about 24 weeks – three weeks shorter than the record high in May last year.

Susquehanna reports the December 2022 lead time was shortened by 8 days — the most significant monthly drop since 2017 — but the fact remains this is still much higher than the 10 to 15 weeks before the COVID-19 pandemic.

“Delivery wait times across all product categories have shrunk in December,” said Susquehanna analyst Chris Rolland, adding that lead times for all key product categories are shortening, with power management and analog chips seeing the largest declines in wait times for delivery.

The report also pointed out that Infineon’s lead time was shortened by 23 days, Texas Instruments by four weeks, and Microchip by 24 days.

02. TI: Weakness in all markets except automotive

Texas Instruments recently forecast that its first-quarter revenue and profit would fall well short of Wall Street's targets as the economic downturn could limit demand in its most resilient market.

Smartphones and personal computer products were the first to suffer from the drop in demand as interest rates rose, and sectors such as industrials have also started to come under pressure.

TI said revenue in its industrial business fell 10% in the fourth quarter from the previous quarter, while its communications equipment and enterprise systems business fell 20%. TI expects demand to be less than seasonally down in the current quarter as customers prefer to reduce inventories.

TI CEO Rich Templeton said the automotive market was the only exception to weak demand. However, some analysts said that orders in the auto market have begun to slow, but have not yet turned negative.

03. ST sees slower growth for 2023, maintains capital expenditure

Despite a year of 26% growth and capacity sold out for 2023, STMicroelectronics is also highlighting the coming slowdown in the semiconductor market.

ST reported fourth quarter net revenues of $4.42 billion and profits of $1.25 billion, bringing the year over $16bn. The company is also increasing its capital expenditure for its 300mm fab in Crolles, France and for silicon carbide fab and substrate plant in Catania, Italy

“FY22 revenues increased 26.4% to $16.13 billion, driven by strong demand in automotive and industrial,” said Jean-Marc Chery, STMicroelectronics President & CEO.. “We invested $3.52 billion in capex while delivering free cash flow of $1.59 billion. Our first quarter business outlook, at the mid-point, is for net revenues of $4.20 billion, increasing year-over-year by 18.5% and decreasing sequentially by 5.1%.”

“In 2023 we will drive the company in the range of $16.8 to $17.8bn, representing growth of 4 to 10% over 2022,” he said. “Automotive and industrial will be the key growth drivers and we plan to invest $4bn in capex, 80% for the increase in the 300mm fab and SiC including the substrate initiative, the remaining 20% is for R&D and laboratories.”

“It is clear that all areas related to automotive and B2B industrial [including power and automotive microcontrollers] our capacity is fully booked for the year,” said Chery.

04. Omdia: Sony holds 51.6% of the CIS market

According to Omdia's ranking of the global CMOS image sensor market, Sony's image sensor sales in the third quarter of 2022 reached $2.442 billion, accounting for 51.6% of the market, further widening the gap with the second-ranked Samsung, which accounted for 15.6%.

The third to fifth places are OmniVision, onsemi, and GalaxyCore, with market shares of 9.7%, 7%, and 4% respectively. Samsung's sales in the third quarter of last year reached US$740 million, down from US$800 million to US$900 million in previous quarters, and Sony continued to expand its market share driven by orders for smartphones such as the Xiaomi Mi 12S Ultra.

In 2021, Samsung's CIS market share reached 29%, while Sony's was 46%. In 2022, Sony further widened the gap with the second place. Omdia believes this trend will continue, especially with Sony's upcoming supply of CIS for Apple's iPhone 15 series, which is expected to expand its lead.

05. Intel predicts continued losses in 1Q23

Few things went right for chip giant Intel in the fourth quarter.

In the PC market, a dramatic tumble in demand that played out in the second half of 2022 transformed component shortages into gluts. Intel shipped PC central processing units (CPUs) at a rate that was about 10% below consumption throughout 2022, with that gap expanding in Q4 and expected to further widen in Q1 2023. The first quarter will mark "the most significant inventory digestion in our data set," according to CEO Pat Gelsinger.

The market for server CPUs isn't in as bad a shape, but it's deteriorating. Inventory corrections are playing out there as well, with Intel seeing server CPU shipments dropping by a mid-single-digit rate in 2022. On top of weakening demand in a tough economy, Intel is losing share in the data center to rival Advanced Micro Devices and its powerful Genoa chips.

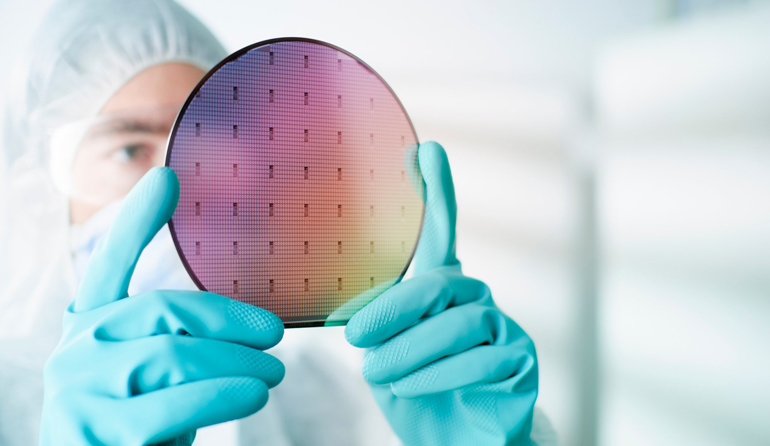

06. ADI upgrades Oregon fab to expand capacity

According to reports, ADI is spending $1 billion to upgrade its semiconductor factory near Beaverton, Oregon, which will double its production capacity.

“We are making significant investments to modernize our existing manufacturing space, retool equipment to increase productivity, and expand our overall infrastructure by adding 25,000 square feet of additional cleanroom space,” said Fred Bailey, vice president of factory operations at ADI.

The report pointed out that the factory mainly produces high-end analog chips that can be used for heat source management and thermal control. The target market is mainly in the fields of industry and automobiles. This can avoid the impact to a certain extent under the current weak demand in the consumer electronics market.

07. onsemi announces strategic agreement with Volkswagen Group to strengthen SiC technology in next-generation electric vehicles

onsemi recently announced that it signed a strategic agreement with German Volkswagen AG (VW) to provide modules and semiconductors that enable a complete electric vehicle (EV) traction inverter solution for VW’s next-generation platform family. The semiconductors are part of an overall system optimization and provide a solution that will support the front and rear traction inverters in the VW models.

As part of the agreement, onsemi will deliver in a first step its EliteSiC 1200 V traction inverter power modules. The EliteSiC power modules are pin to pin compatible to easily scale the solution to different power levels and types of motors. Teams from the two companies have been collaborating for more than a year on the optimization of the power modules for the next generation platform, with pre-production samples under development and evaluation.