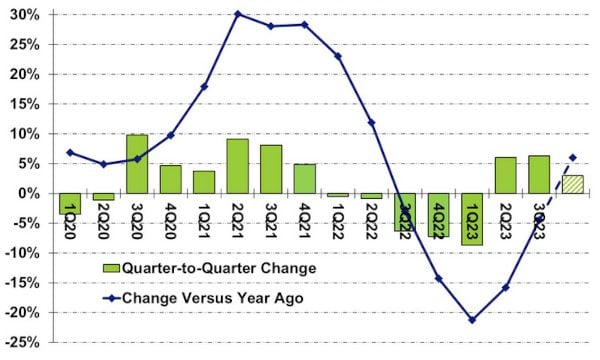

01. Chip market rebound points to 16% growth in 2024

The global chip market is now rebounding and this will deliver 16 percent annual growth in 2024, according to Semiconductor Intelligence.

This puts the market researcher in the middle of a range of growth figures from forecasters that vary between 9 and 20 percent.

But the growth forecast is highly polarized. The prospects are relatively weak for chip companies focused primarily on automotive, industrial and IoT – Texas Instruments, Infineon, ST, NXP, Analog Devices, Renesas. The strongest revenue growth in 2024 is expected to come from the memory companies – Samsung, SK Hynix, and Micron – and the smartphone and computing-focused companies – Nvidia, Intel, AMD, MediaTek, Qualcomm.

02. High-End AI Server Shipments in china Expected to Be Below 4% in 2024

TrendForce reports that North American CSPs like Microsoft, Google, and AWS will remain key drivers of high-end AI servers (including those with NVIDIA, AMD, or other high-end ASIC chips) from 2023 to 2024. Their estimated shipments are expected to be 24%, 18.6%, and 16.3%, respectively, for 2024.

Chinese CSPs such as ByteDance, Baidu, Alibaba, and Tencent (BBAT) are projected to have a combined shipment share of approximately 6.3% in 2023. However, this could decrease to less than 4% in 2024, considering the current and potential future impacts of the ban.

03. NVIDIA delays new H20 AI GPU shipments in to China

NVIDIA was expected to have its new H20 AI GPU making its way into China by now, but it has been delayed by many months and won't see an introduction into the Chinese market until Q1 of 2024.

which is reporting that NVIDIA has told customers in China that it's delaying the launch of its new AI chip — which is designed to comply with US export rules — until February or March 2024. NVIDIA was expected to launch its new H20 AI GPU in China on November 16, but now it's months away.

04. ADI: Q4 revenue fell 16% year-on-year due to high inventories

November 23, 2023, Analog Devices (ADI) said in its recently released fourth quarter report that its revenue fell 16% year-on-year to $2.72 billion due to high inventory, but was slightly higher than the $2.7 billion expected by a FactSet survey.

According to ADI's report, only automotive chip revenue grew positively in the fourth quarter, up 14% year-on-year to US$730 million, with automotive accounting for 27% of overall revenue. Industrial revenue accounts for about 50% and is the largest source of revenue. However, revenue in the fourth quarter fell 20% year-on-year to US$1.35 billion.

ADI CEO Vincent Roche said that demand for industrial semiconductors is weak, and almost all applications have seen declines. Only the defense and aerospace industry still maintains a certain demand.

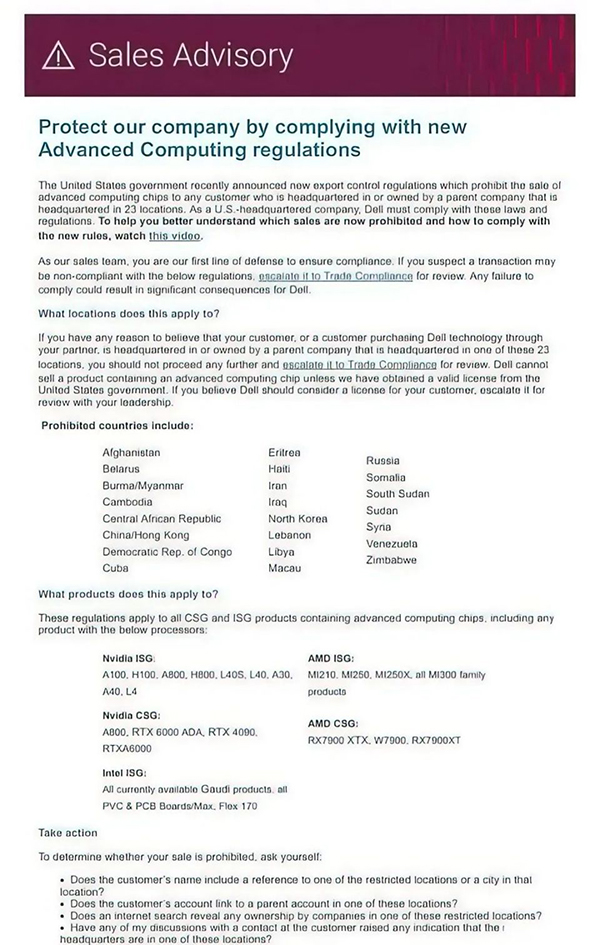

05. Dell Prohibits Sales of AMD Radeon RX 7900 XTX, 7900 XT, PRO W7900 & Upcoming MI300 GPUs In China

AMD's Radeon & Instinct GPUs including the RX 7900 XTX, 7900 XT, PRO W7900 & the upcoming MI300 are now prohibited from sales in China according to a sales advisory guide that's allegedly been rolled out by Dell.

In its sales advisory report, Dell highlights a range of AMD products that have now been prohibited from sales within China and 23 other locations.

The products that have been banned include the Instinct accelerators that are offered under its ISG (Infrastructure Solutions Group) and Radeon GPUs that are offered under its CSG (Client Solutions Group). The banned Dell "AMD ISG" products include the Instinct MI210, MI250, MI250X & even the upcoming MI300 family.

06. Toshiba to delist in Japan on Dec. 20 after 74 years of history

Toshiba Corp will officially become a private company this coming December after accepting a more than $13 billion takeover bid.

The Toyko-based electronics giant announced Thursday it has scheduled an upcoming “extraordinary shareholder meeting” to hammer out the details of the private takeover and delisting of its shares.

Toshiba said the shareholders meeting, scheduled for November 22, is being held to vote on the upcoming consolidation of its shares, as part of the takeover process.

07. NVIDIA continues to dominate the high-end chip market

As 2024 rolls around, a number of AI chip suppliers are pushing out their latest product offerings. NVIDIA’s current high-end AI lineup for 2023, which utilizes HBM, includes models like the A100/A800 and H100/H800. In 2024, NVIDIA plans to refine its product portfolio further. New additions will include the H200, using 6 HBM3e chips, and the B100, using 8 HBM3e chips. NVIDIA will also integrate its own Arm-based CPUs and GPUs to launch the GH200 and GB200, enhancing its lineup with more specialized and powerful AI solutions.

Contrastingly, AMD’s 2024 focus is on the MI300 series with HBM3, transitioning to HBM3e for the next-gen MI350. The company is expected to start HBM verification for MI350 in 2H24, with a significant product ramp-up projected for 1Q25.