December 13, 2021, Global Semiconductor Manufacturing Equipment Sales by Original Equipment Manufacturers Expected to Hit New High of 103 billion dollars in 2021, up 44.7% from the previous industry record $ 71 billion in 2020, SEMI announced by releasing its Year-End Total Semiconductor Equipment Forecasts – OEM Perspective to SEMICON Japan 2021. Growth is expected to continue as the global semiconductor manufacturing equipment market expands to 114 billion dollars by 2022.

“Cross the $ 100 billion brand in total sales of semiconductor manufacturing equipment reflects the concerted and outstanding willingness of the global semiconductor industry to expand capacity to meet strong demand, ”said Ajit Manocha, Chairman and CEO of SEMI. “We anticipate that continued investments in building digital infrastructure and secular trends in several end markets will fuel healthy growth in 2022.”

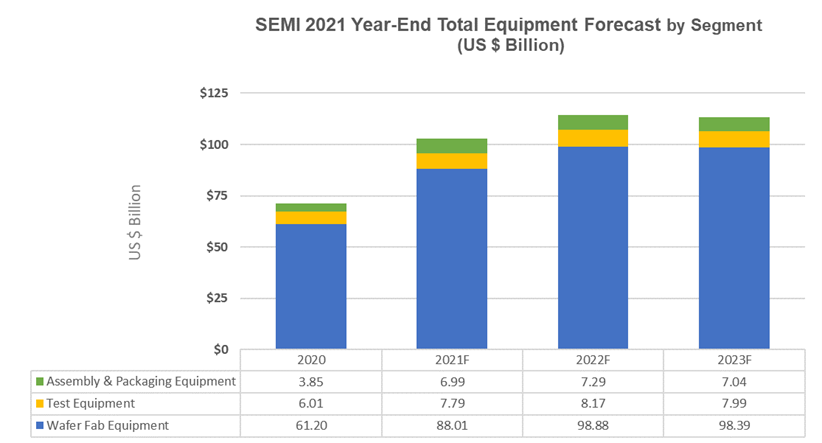

The front-end (wafer fab) and back-end (assembly / packaging and testing) semiconductor equipment segments are contributing to global expansion. The wafer manufacturing equipment segment, which includes wafer processing, manufacturing facilities and mask / reticle equipment, is expected to grow 43.8% to a new industry record of $ 88 billion in 2021, followed by an increase of 12.4% in 2022 to around $ 99 billion. Wafer manufacturing equipment in 2023 is expected to decrease slightly by -0.5% to $ 98.4 billion.

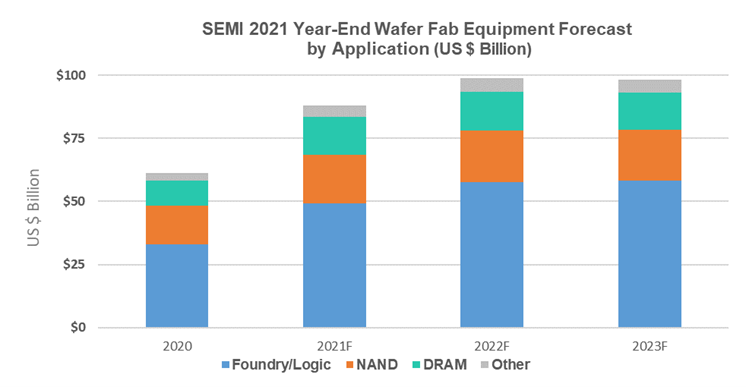

The foundry and logic segments, which account for more than half of total wafer making equipment sales, will grow 50% year over year to reach $ 49.3 billion in 2021 thanks to the demand for peak and mature nodes. The growth dynamic should continue in 2022 with investments in foundry and logic equipment up 17%.

Strong business and consumer demand for memory and storage is contributing to strong spending on DRAM and NAND equipment. The DRAM equipment segment leads the expansion in 2021 with a 52% jump to $ 15.1 billion and growing by 1% in 2022 for $ 15.3 billion. The NAND equipment market is expected to jump 24% in 2021 for $ 19.2 billion and 8% in 2022 to $ 20.6 billion. Spending is expected to decrease by -2% and -3% in 2023 for DRAM and NAND respectively.

After experiencing robust growth of 33.8% in 2020, the assembly and packaging equipment segment is expected to grow by 81.7% to reach $ 7 billion in 2021, followed by another 4.4% increase in 2022 thanks to advanced packaging applications. Semiconductor test equipment market is expected to grow 29.6% in 2021 to reach $ 7.8 billion and continues to grow 4.9% in 2022 driven by 5G and high performance computing (HPC) applications.

At the regional level, China, Korea and Taiwan are expected to remain the top three destinations for capital spending in 2021. China is expected to retain the top position, which he first claimed in 2020, while Taiwan should regain first place in the market in 2022 and 2023. Capital expenditure for all regions monitored should increase in 2021 and 2022.