1. Ukraine halts half of world's neon output for chips, clouding outlook

Ukrainian neon supply firms Ingas and Cryoin have recently closed down following continued Russia's war with Ukraine.

According to reports, Ukraine alone produces half of the world's neon, which are important components in the production of electronic chips. Reports further suggest that there have been threats to raise prices and aggravate the semiconductor shortage as well.

Some 45% to 54% of the world's semiconductor-grade neon, critical for the lasers used to make chips, comes from two Ukrainian companies, Ingas and Cryoin, according to Reuters calculations based on figures from the companies and market research firm Techcet. Global neon consumption for chip production reached about 540 metric tons last year, Techcet estimates.

Both firms have shuttered their operations, according to company representatives contacted by Reuters, as Russian troops have escalated their attacks on cities throughout Ukraine, killing civilians and destroying key infrastructure.

The stoppage casts a cloud over the worldwide output of chips, already in short supply after the Covid-19 pandemic drove up demand for cell phones, laptops and later cars, forcing some firms to scale back production.

While estimates vary widely about the amount of neon stocks chipmakers keep on hand, production could take a hit if the conflict drags on, according to Angelo Zino, an analyst at CFRA.

"If stockpiles are depleted by April and chipmakers don't have orders locked up in other regions of the world, it likely means further constraints for the broader supply chain and inability to manufacture the end-product for many key customers," he said.

2. Wingtech Inks $791M Smart Home Deal With Apple

Wingtech, a manufacturing company that assembles smartphones and other consumer electronics, announced on Thursday that it has carried out a number of business cooperations with an overseas customer, covering fields including computers and smart homes. Mass production and shipment of the 5 billion yuan ($791 million) project is already underway.

China Securities Journal reporters learned from supply chain sources that the overseas customer mentioned by Wingtech refers to Apple, and its cooperation regarding the smart home project alone reaches about 5 billion yuan.

Last year, Wingtech entered Apple’s supply chain by acquiring the related assets of Apple’s original partner Ofilm. In October last year, Wingtech passed Apple’s examination and got the exclusive assembly order for Apple’s new MacBook Air in 2022. Wingtech has started to establish production lines in the Chinese provinces of Zhejiang, Jiangsu and Yunnan. In addition, Wingtech obtained other orders from Apple.

According to Wingtech, the company’s product integration business has expanded from smartphones to tablets, laptops, IoT, servers and automotive electronics, which enables the company to accumulate rich experience in R&D and manufacturing. The cooperation between the company and specific overseas customers will have a positive impact on the company’s operating results in 2022 and future years.

3. Toyota will cut domestic production 20% to ease strain on supply chain

Toyota Motor has told suppliers it will cut domestic production by up to 20% from a previous plan for the three months from April, it said on Friday, to ease the strain on suppliers struggling with shortages of chips and other parts.

Toyota's suppliers have been forced to deal with a number of changes to production plans due to the shortages, a Toyota spokesperson said, adding that the reduction in output should take some of the burden off them.

The automaker is planning to scale back domestic production by about 20% in April, about 10% in May and about 5% in June from its previous plan, the spokesperson said.

Toyota President Akio Toyoda told a Wednesday meeting with union members that suppliers would be "exhausted" unless there was a "sound" production plan.

Toyoda said April through June would be "an intentional cooling off" period to make safety and quality the highest priorities.

The spokesperson said the effort was a reflection of Toyoda's intention to share information early with suppliers so they can plan their production.

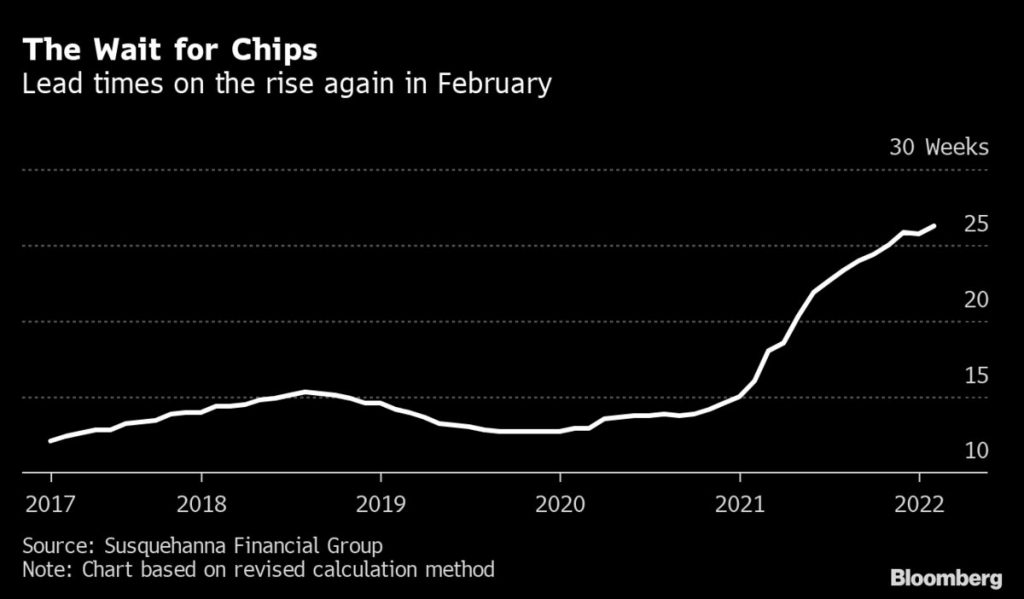

4. Lead times increased by three days to 26.2 weeks in February

The wait times for semiconductor deliveries rose again in February, a sign that shortages are continuing to bedevil chip buyers in a wide range of industries.

Lead times — the lag between when a chip is ordered and delivered — increased by three days to 26.2 weeks last month, according to research by Susquehanna Financial Group. In January, the group reported that delays were getting shorter, the first sign of improvement since 2019.

Though the lag times have now increased again, they aren’t growing quite as quickly as during much of 2021. But certain sectors were hit worse than others. Delivery times for microcontrollers reached a high of 35.7 weeks in February, according to Susquehanna’s research. Lead times also increased by a week-and-a-half for power-management components. Both are essential parts of many electronics, including car components.

The global shortage of semiconductors began in the first half of 2020, driven by pandemic-fueled demand for consumer technology and vehicles. The scarcity of chips has held back production of everything from smartphones to pickup trucks, leading to billions in lost revenue and contributing to inflation by raising costs.

The Biden administration said in January that it anticipated the shortage to continue until at least the second half of the year. Chip industry executives have cautioned that some chip users won’t be able to get all that they need until into 2023.

5. Experts Predict Russia-Ukraine Conflict Will Slash Global Vehicle Production

Experts predict the Russian invasion of Ukraine could slash global production of new cars and trucks by millions of units in 2022.

Russia will see the greatest impacts as companies suspend operations in the country. But experts warn that the longer the war ensures the greater the effect it will have on the global automotive industry.

The Russian invasion has already generated new supply problems in an industry already plagued by supply disruptions. Wire harnesses, which act as a vehicle’s wiring system, are now in short supply. Catalytic converters and semiconductor chips also will be affected as these parts use materials and gases from the region.

Forecasts surrounding the impact on vehicle output vary given the fluidity of the situation. But most say the conflict could reduce output by millions of units.

The European vehicle market will experience the effects faster than the U.S. and other markets. Audi and Mercedes-Benz already announced plans to cut production output due to parts disruptions out of Ukraine.

UBS Analyst Patrick Hummel notes wire harnesses are the most critical bottleneck to date, already leading to significant product interruption among German automakers.

AutoForecast Solutions expects vehicle production this year in Russia and Ukraine to fall 50%, to around 800,000 units, because of the conflict.

Research firm IHS Markit expects the global impact this year to be around 3.5 million fewer vehicles when added to existing semiconductor chip constraints. Russia and Ukraine represent critical sources of neon gas and palladium used in semiconductor chips.

Tim Urquhart, a European principal automotive analyst at IHS, famous the scenario stays fluid. In December, IHS forecast world gross sales of 82.4 million autos in 2022, up 3.7% 12 months over 12 months.