01.Supply chain: Automotive IGBT supply is still tight

According to the supply chain, automotive IGBT and other power ICs are still in tight supply.

Sources said that the price of power chips has fallen sharply, MOSFET and diode demand have been sluggish, and the inventory in the supply chain has surged. However, the supply of automotive semiconductors, including Infineon, STMicroelectronics, onsemi, and Rohm, is lower than demand. The price of automotive IGBTs and several other power chips is still high due to the supply shortage.

The sources pointed out that lead times for automotive and photovoltaic IGBTs are still long, while shortages of IGBTs for consumer electronics are improving. At the same time, the supply of industrial IGBTs remains tight.

The source further revealed that the current delivery time of IDM's automotive IGBTs is about 40-50 weeks, and the chip supply gap is estimated to be 40%-50%.

02.Display driver IC suppliers to cut prices to cut inventory

According to the semiconductor supply chain, display driver IC makers have significantly scaled back foundry production, but inventories remain high.

Sources pointed out that display driver IC makers have cut wafer production in the fourth quarter of 2022 and 2023 as display panel makers began to cut production amid slowing market demand, but inventories remained at fairly high levels. Therefore, they plan to reduce the inventory through a price reduction strategy.

"Demand for OLED display driver ICs has been disappointing due to poor Android smartphone sales, and suppliers have seen customers delay order processing rather than cancel it," the source said.

03.TE Connectivity China issues price increase notice

According to the supply chain, TE Connectivity China issued a price increase notice, saying that it will increase the price from December 1, 2022.

TE Connectivity said in the notice that over the past two years, freight and energy costs have risen due to global inflation, increased manufacturing costs, wars, trade wars, Covid and other factors beyond its control.

TE said it had been working to minimise the overall impact by further streamlining procurement and process efficiencies, pressures, but it was now beyond what TE could handle.

TE China mentioned in the notice that the TE headquarters and other regions have communicated with customers about the price adjustment plan and have begun to implement it gradually. Therefore, TE China will adjust the price of the product according to the situation. The new prices, once agreed, will take effect on December 1, 2022.

TE China said the new prices apply to new orders received from the adjustment date and products delivered since the adjustment date. As of the adjustment date, TE will not accept any new orders if the price stated in the order is lower than the new adjusted price.

04.NXP Semiconductors Reports Third Quarter 2022 Results

EINDHOVEN, The Netherlands, Oct. 31, 2022 (GLOBE NEWSWIRE) — NXP Semiconductors N.V.reported financial results for the third quarter, ended October 2, 2022.

“NXP delivered quarterly revenue of $3.45 billion, an increase of 20 percent year-on-year and above the mid-point of our guidance range. Overall in the third quarter, we performed very well; however, we were impacted by the weakening macro-environment in our consumer-exposed IoT business. At the same time, demand in both the automotive and industrial markets continues to be resilient, driven by secular and company-specific drivers, along with incrementally improved supply. Looking ahead, while we continue to be supply constrained, we are cautious in the intermediate term, due to the uncertainties in the macro environment," said Kurt Sievers, NXP President and Chief Executive Officer.

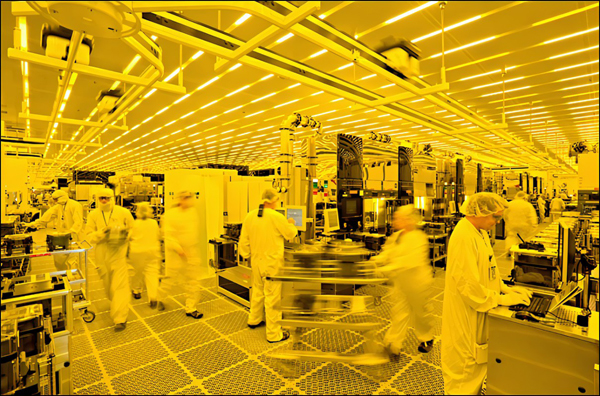

05.41 new fabs to be added globally from 2022 to 2025

According to reports, after the semiconductor shortage, a wave of fab expansion will be set off from 2022 to 2025, and 41 new fabs will be added worldwide during this period.

The report pointed out that among these expansions, TSMC, Samsung and Intel have expanded production in the United States. Therefore, 9 fabs will be built in the United States in the next three years.

Due to the growth of semiconductor application demand and geopolitical factors, there will be 41 fabs under construction around the world from 2022 to 2025. In total, 32 fabs are located in Asia and are mainly 12-inch fabs. From a regional perspective, the United States is the country with the largest number of new fabs, with a total of 9 new fabs, including 8 12-inch fabs and 1 8-inch fab.

06.Murata announces construction of new production building in China

Murata Manufacturing Co., Ltd. announced that its manufacturing subsidiary Wuxi Murata Electronics Co., Ltd. has started construction of a new production building and associated buildings in November 2022.

The purpose of this construction project is to provide the infrastructure necessary to respond to growing demand for multilayer ceramic capacitors in a medium- to long-term capacity.

The total investment of the factory is about 44.5 billion yen, with a total construction area of 51,289 square meters and a construction area of 11,763 square meters. It is expected to be completed by the end of April 2024.

07.onsemi completes sale of Pocatello, Idaho fab

According to reports, onsemi has completed the sale of its 200mm wafer fab in Pocatello, Idaho, to LA Semiconductor, a pure-play semiconductor foundry operating in the United States for the production of analog, mixed-signal and power products.

onsemi's 33-acre Pocatello facility has over 50,000 square feet of cleanroom space and over 550,000 square feet of building space and currently produces 0.35μm to 1.5μm analog CMOS, BCD processes, advanced discretes and custom process technology.

"This divestment is a continuation of onsemi's fab-liter strategy to achieve sustainable financial performance by expanding production capacity for products in key markets of automotive and industrial," said Wei-Chung Wang, executive vice president of global manufacturing and operations at onsemi.