Taiwan Semiconductor Manufacturing Company (TSMC) has pared back its plan to spend more than $40 billion this year for capacity expansion. The outlook for demand has worsened on expectations of an inventory reduction in the PC and consumer electronics segments.

At a quarterly result meeting on July 14, TSMC predicts its capital expenditure this year will reach about $40 billion. Three months ago, the company forecasted that number could have reached $44 billion.

“Due to the softening device momentum in smartphone, PC, and consumer end–market segments, we observe the supply chain is already taking action and expect inventory levels to reduce throughout the second half of 2022,” said TSMC CEO C.C. Wei at the event. “We believe the current semiconductor cycle will be more similar to a typical cycle, with a few quarters of inventory adjustment likely through first half 2023.”

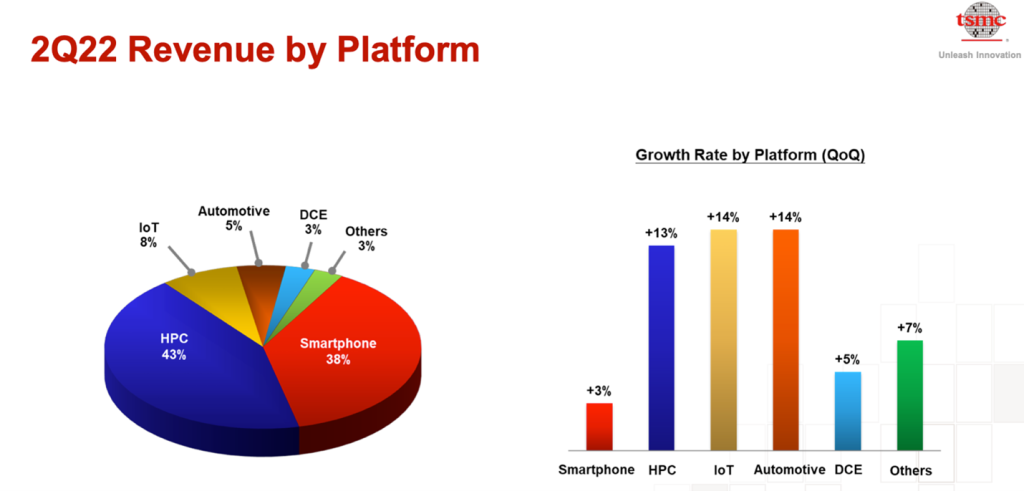

The world’s top–ranked chip foundry, which makes semiconductors for customers ranging from Apple to Xilinx, is a bellwether for the electronics industry. While the consumer electronics segment slows, TSMC said it’s still not able to keep up with demand, especially in the high–performance computing (HPC) segment that now accounts for the largest portion of its revenue. The company expects HPC to be the main engine of its long–term growth.

Data center and automotive–related demand remains solid, and the company has been reallocating capacity to support these areas. TSMC expects its capacity to remain tight throughout 2022, and predicts its full–year growth to reach the mid–30% range in U.S. dollar terms.

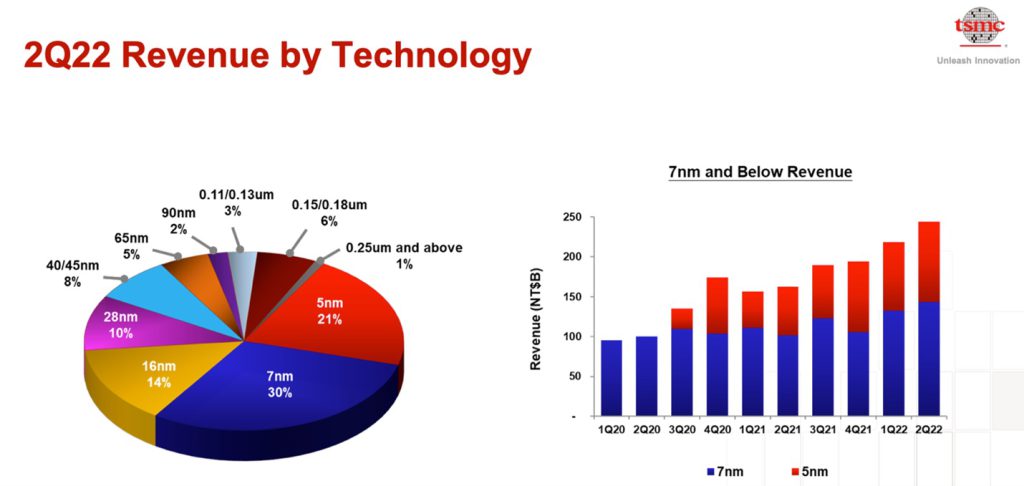

The drive by HPC customers to meet performance and energy–efficiency targets is fueling demand for TSMC’s leading–edge technologies at the 7nm and 5nm process nodes, which together accounted for 51% of its second–quarter revenue.

The company leads foundry rivals such as Samsung and Intel in the advanced 7nm and 5nm nodes, where TSMC had more than 90% of the market, according to market research firm Gartner.

While macroeconomic headwinds may persist, silicon content is increasing in end devices, fueled by process technology migration and increased functionality, according TSMC. The number of CPUs, GPUs, and AI accelerators in data centers is increasing, the chipmaker said.

A shortage in supply of chip–making equipment, such as extreme ultraviolet (EUV) lithography tools, has also constrained TSMC’s ability to expand production capacity.

“Our suppliers have been facing greater challenges in their supply chains, which are extending delivery lead times for both advanced and mature nodes,” Wei said. “As a result, we expect some of our capex this year to be pushed out into 2023.”

TSMC also said that the cost of building its new 5nm fab in Arizona will be higher than expected.

“During these past two years, we found that the labor cost in the States is higher than we planned,” TSMC chairman Mark Liu said at the event. “Some of the Covid supply chain interruptions also were unexpected.”

“Our customers in the U.S. all want to load that fab,” he added. “We also believe there is ample business opportunity there. The cost is increasing, but cost is not the only factor. We are still working on government subsidies, and we’ll continue working on cost reduction.”

TSMC is counting on a yet–to–be approved package of subsidies from the U.S. government worth $52 billion that is aimed at reviving the American chip industry.